Do You Pay Taxes On Vehicles In Texas . texas collects a 6.25% state sales tax rate on the purchase of all vehicles. tax, title, and license fee on a new car in texas that costs $25,000 would be around $1,700. Motor vehicle sales tax is due on each retail sale of a motor vehicle in. motor vehicle tax guide. there is a 6.25% sales tax on the sale of vehicles in texas. when you purchase a car, you'll need to know due dates for vehicle taxes and how. do i owe motor vehicle tax? Some dealerships may charge a documentary. However, there may be an extra local or county sales tax added onto the base. texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of. A motor vehicle purchased in texas to be leased is subject to motor vehicle sales tax.

from www.houstonchronicle.com

tax, title, and license fee on a new car in texas that costs $25,000 would be around $1,700. motor vehicle tax guide. do i owe motor vehicle tax? However, there may be an extra local or county sales tax added onto the base. A motor vehicle purchased in texas to be leased is subject to motor vehicle sales tax. there is a 6.25% sales tax on the sale of vehicles in texas. Motor vehicle sales tax is due on each retail sale of a motor vehicle in. when you purchase a car, you'll need to know due dates for vehicle taxes and how. texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of. Some dealerships may charge a documentary.

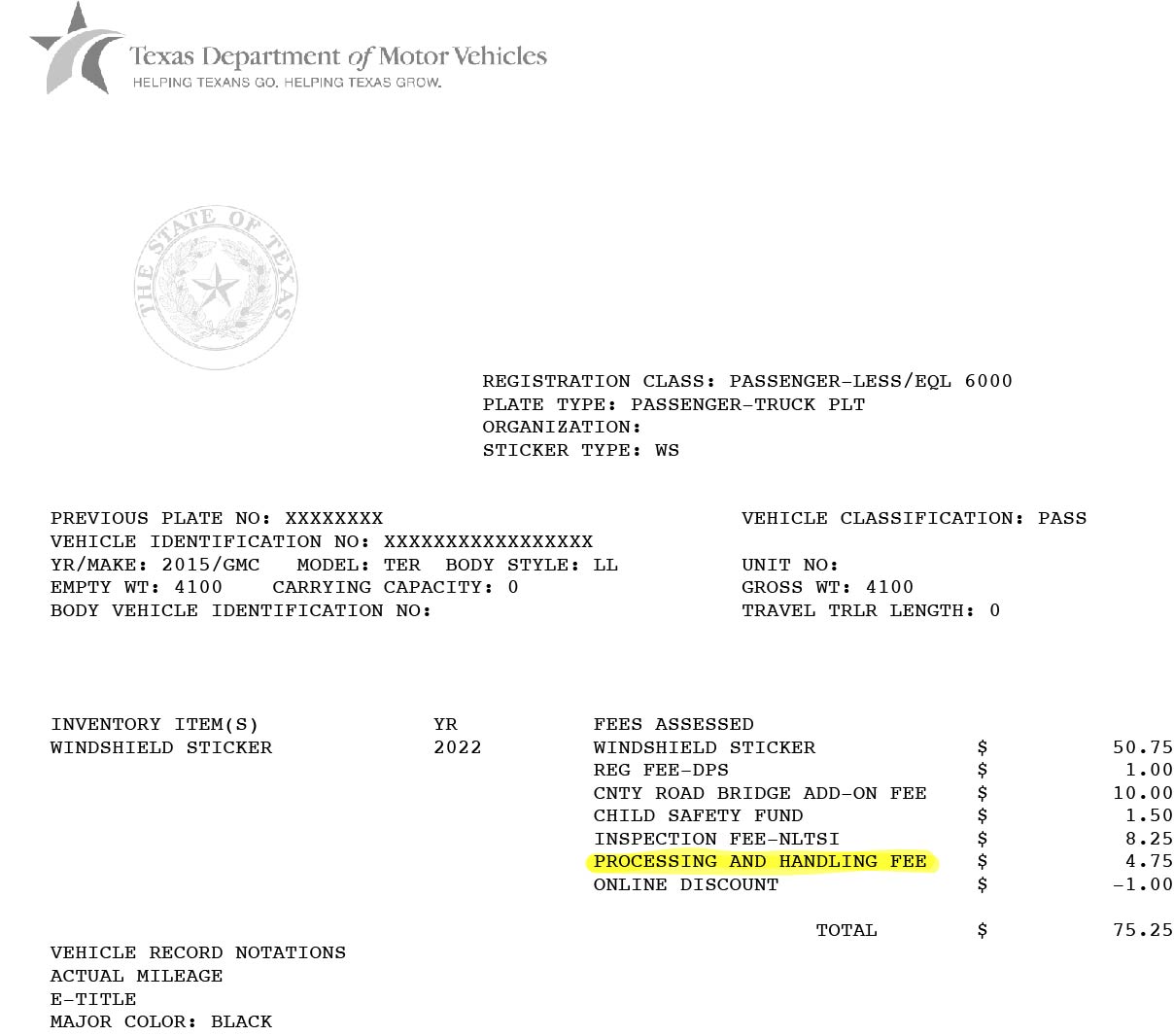

Texas vehicle registration fees Here's how it works in Harris County

Do You Pay Taxes On Vehicles In Texas texas collects a 6.25% state sales tax rate on the purchase of all vehicles. Some dealerships may charge a documentary. texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of. motor vehicle tax guide. Motor vehicle sales tax is due on each retail sale of a motor vehicle in. when you purchase a car, you'll need to know due dates for vehicle taxes and how. However, there may be an extra local or county sales tax added onto the base. A motor vehicle purchased in texas to be leased is subject to motor vehicle sales tax. texas collects a 6.25% state sales tax rate on the purchase of all vehicles. there is a 6.25% sales tax on the sale of vehicles in texas. do i owe motor vehicle tax? tax, title, and license fee on a new car in texas that costs $25,000 would be around $1,700.

From greenwoodco.corebtpay.com

Vehicle Taxes / Greenwood County, SC Do You Pay Taxes On Vehicles In Texas texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of. Some dealerships may charge a documentary. when you purchase a car, you'll need to know due dates for vehicle taxes and how. do i owe motor vehicle tax? A motor vehicle purchased in texas. Do You Pay Taxes On Vehicles In Texas.

From www.gobankingrates.com

Sales Tax by State Here's How Much You're Really Paying GOBankingRates Do You Pay Taxes On Vehicles In Texas Some dealerships may charge a documentary. However, there may be an extra local or county sales tax added onto the base. do i owe motor vehicle tax? there is a 6.25% sales tax on the sale of vehicles in texas. tax, title, and license fee on a new car in texas that costs $25,000 would be around. Do You Pay Taxes On Vehicles In Texas.

From taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates Tax Foundation Do You Pay Taxes On Vehicles In Texas texas collects a 6.25% state sales tax rate on the purchase of all vehicles. Motor vehicle sales tax is due on each retail sale of a motor vehicle in. texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of. However, there may be an extra. Do You Pay Taxes On Vehicles In Texas.

From fity.club

Vehicle Tax Do You Pay Taxes On Vehicles In Texas do i owe motor vehicle tax? texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of. texas collects a 6.25% state sales tax rate on the purchase of all vehicles. there is a 6.25% sales tax on the sale of vehicles in texas.. Do You Pay Taxes On Vehicles In Texas.

From vimcar.co.uk

HMRC Company Car Tax Rates 2020/21 Explained Do You Pay Taxes On Vehicles In Texas do i owe motor vehicle tax? there is a 6.25% sales tax on the sale of vehicles in texas. tax, title, and license fee on a new car in texas that costs $25,000 would be around $1,700. texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor. Do You Pay Taxes On Vehicles In Texas.

From carretro.blogspot.com

How Much Do You Pay For Tax On A Car Car Retro Do You Pay Taxes On Vehicles In Texas However, there may be an extra local or county sales tax added onto the base. Motor vehicle sales tax is due on each retail sale of a motor vehicle in. A motor vehicle purchased in texas to be leased is subject to motor vehicle sales tax. motor vehicle tax guide. Some dealerships may charge a documentary. do i. Do You Pay Taxes On Vehicles In Texas.

From www.youtube.com

Huge increase in the taxes on vehicles Budget 202324 proposes more Do You Pay Taxes On Vehicles In Texas do i owe motor vehicle tax? there is a 6.25% sales tax on the sale of vehicles in texas. texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of. A motor vehicle purchased in texas to be leased is subject to motor vehicle sales. Do You Pay Taxes On Vehicles In Texas.

From www.keepertax.com

Writing Off a Car Ultimate Guide to Vehicle Expenses Do You Pay Taxes On Vehicles In Texas texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of. A motor vehicle purchased in texas to be leased is subject to motor vehicle sales tax. However, there may be an extra local or county sales tax added onto the base. Some dealerships may charge a. Do You Pay Taxes On Vehicles In Texas.

From fity.club

Vehicle Tax Do You Pay Taxes On Vehicles In Texas when you purchase a car, you'll need to know due dates for vehicle taxes and how. texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of. A motor vehicle purchased in texas to be leased is subject to motor vehicle sales tax. tax, title,. Do You Pay Taxes On Vehicles In Texas.

From numberimprovement23.bitbucket.io

How To Check If Car Is Taxed Numberimprovement23 Do You Pay Taxes On Vehicles In Texas tax, title, and license fee on a new car in texas that costs $25,000 would be around $1,700. Motor vehicle sales tax is due on each retail sale of a motor vehicle in. do i owe motor vehicle tax? when you purchase a car, you'll need to know due dates for vehicle taxes and how. motor. Do You Pay Taxes On Vehicles In Texas.

From www.whipflip.com

Do You Pay Taxes When You Sell A Car? Do You Pay Taxes On Vehicles In Texas there is a 6.25% sales tax on the sale of vehicles in texas. However, there may be an extra local or county sales tax added onto the base. texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of. motor vehicle tax guide. tax,. Do You Pay Taxes On Vehicles In Texas.

From www.rapidcarcheck.co.uk

How To Check Car Tax And MOT Due Dates Now Rapid Car Check Do You Pay Taxes On Vehicles In Texas there is a 6.25% sales tax on the sale of vehicles in texas. However, there may be an extra local or county sales tax added onto the base. tax, title, and license fee on a new car in texas that costs $25,000 would be around $1,700. texans who buy a used vehicle from anyone other than a. Do You Pay Taxes On Vehicles In Texas.

From www.express.co.uk

Car tax changes Road charges are 'confusing' and should be ‘made Do You Pay Taxes On Vehicles In Texas Some dealerships may charge a documentary. there is a 6.25% sales tax on the sale of vehicles in texas. texas collects a 6.25% state sales tax rate on the purchase of all vehicles. Motor vehicle sales tax is due on each retail sale of a motor vehicle in. texans who buy a used vehicle from anyone other. Do You Pay Taxes On Vehicles In Texas.

From automotivesblog.com

How to Buy a Used Car Complete Guide Automotivesblog Do You Pay Taxes On Vehicles In Texas motor vehicle tax guide. tax, title, and license fee on a new car in texas that costs $25,000 would be around $1,700. when you purchase a car, you'll need to know due dates for vehicle taxes and how. texas collects a 6.25% state sales tax rate on the purchase of all vehicles. texans who buy. Do You Pay Taxes On Vehicles In Texas.

From www.houstonchronicle.com

Texas vehicle registration fees Here's how it works in Harris County Do You Pay Taxes On Vehicles In Texas when you purchase a car, you'll need to know due dates for vehicle taxes and how. motor vehicle tax guide. However, there may be an extra local or county sales tax added onto the base. Motor vehicle sales tax is due on each retail sale of a motor vehicle in. texans who buy a used vehicle from. Do You Pay Taxes On Vehicles In Texas.

From draw-vip.blogspot.com

States Without Property Tax On Cars Drawvip Do You Pay Taxes On Vehicles In Texas However, there may be an extra local or county sales tax added onto the base. do i owe motor vehicle tax? A motor vehicle purchased in texas to be leased is subject to motor vehicle sales tax. texas collects a 6.25% state sales tax rate on the purchase of all vehicles. when you purchase a car, you'll. Do You Pay Taxes On Vehicles In Texas.

From www.youtube.com

how to Pay Vehicle Tax Online Vehicle Road Tax Payment online YouTube Do You Pay Taxes On Vehicles In Texas Motor vehicle sales tax is due on each retail sale of a motor vehicle in. However, there may be an extra local or county sales tax added onto the base. texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of. there is a 6.25% sales. Do You Pay Taxes On Vehicles In Texas.

From ceamofmp.blob.core.windows.net

What Is The Taxes On A Used Car at Mario Smith blog Do You Pay Taxes On Vehicles In Texas motor vehicle tax guide. tax, title, and license fee on a new car in texas that costs $25,000 would be around $1,700. there is a 6.25% sales tax on the sale of vehicles in texas. texas collects a 6.25% state sales tax rate on the purchase of all vehicles. when you purchase a car, you'll. Do You Pay Taxes On Vehicles In Texas.